Winston Churchill is often credited with the advice to “Never let a good crisis go to waste”. In human terms, the Covid-19 outbreak cannot be described as a ‘good’ crisis. It is also arguable that it is not even a crisis yet despite the financial markets generating price charts dripping with fear. We have no idea how long Covid-19 will exert its influence on the global economy but centuries of history would suggest disease, even pandemics, do pass. In contrast, the world of business often has to deal with long-run structural challenges as well as temporary commercial shocks. One chart caught our eye this week and prompted thought.

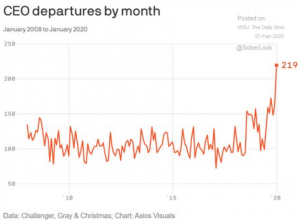

Back in October in “I’m a Celebrity CEO – Get Me Out of Here!” we highlighted an acceleration in the number of CEOs leaving their positions. In fact, July’s total of 159 exits was the highest ever monthly total. Fast forward six months and check out the chart below spiking to a whopping 219 exits this month. This is not a Covid-19 infection chart.

Clearly, the broad sample of departing CEOs from the likes of Google, BP, Boeing, McDonalds, Mastercard and IBM cannot be pinned on the prospect of a global pandemic. However, there is a sneaking suspicion that the flurry of exit announcements in February could be the wise use of a crisis to prevent scrutiny as to executive motivations. While the financial press might be obsessed with virus infection rates, threatened recessions and VP Mike Pence’s comical history of fighting public health crises, there are a number of structural challenges facing the business world on a longer time horizon. We can think of three or four global themes that require critical executive attention.

Clearly, the broad sample of departing CEOs from the likes of Google, BP, Boeing, McDonalds, Mastercard and IBM cannot be pinned on the prospect of a global pandemic. However, there is a sneaking suspicion that the flurry of exit announcements in February could be the wise use of a crisis to prevent scrutiny as to executive motivations. While the financial press might be obsessed with virus infection rates, threatened recessions and VP Mike Pence’s comical history of fighting public health crises, there are a number of structural challenges facing the business world on a longer time horizon. We can think of three or four global themes that require critical executive attention.

First, the Covid-19 outbreak is further ammunition for those wedded to reversing globalism. The concentration of manufacturing assets in China will need to be addressed but is not really a result of globalism. No, the wrongly identified outcome of globalism is income inequality. There is no doubt income inequality is in urgent need of attention – Ireland could be Exhibit A in how to blow an election by confusing the difference between average net income and median net income. The latter metric reveals up to 50% of the country is making no progress as Irish national (average) figures zoom ahead.

The prospect of raising wages and damaging profits and stock options for CEOs is possibly one they’d rather leave to the next boss. Another cost demanded of the markets is also about to rise and initially hit the bottom line. Climate change is real and ESG investment rules are already hurting some very large sectors and their valuations – think Oil & Gas, Steel, Autos and the Transport sector.

Finally, spare a thought for the monster financial services industry. Yet another one of our 10 outlier surprises for 2020, the prospect of US 10 Year Bonds with negative yields, is not that far away. Yields are at 1.15% and falling fast, even before the Fed is bullied by the recession-threatened Orange Toddler to fix (again?) his 2020 election. The news almost as bad as another four years of Trump would be negative interest rates crushing the traditional business models of banks and curtailing lending.

Time will tell if Covid-19 fades into history as a temporary tale of human loss and economic shock. However, there are greater structural challenges ahead and it would appear plenty of CEOs are quitting while they are well ahead in wealth terms and also ahead of difficult commercial decisions. Actions do speak louder than words and particularly pay attention when the easier route is chosen. Churchill, again, put it rather well:

“The problems of victory are more agreeable than those of defeat, but they are no less difficult”