As somebody who has been watching, I’m still stunned. No, not that Rishi Sunak has his own GB News TV show and that the regulator, Ofcom, hides. Not even the fact that a former US President has thrown his NATO allies under the Vlad bus in plain sight of the forever fear-filled US media. Of course, I’m sure Poland and Estonia are terrified by Joe’s age or Hilary’s emails. Mind-boggling. However, on a brighter note there’s another bus which is enabling millions to work better. The AI bus is flying. Again, the mainstream media headlines run with AI fear but the flow of money and corporate action point to an extraordinary business revolution. The numbers are now simply too big for businesses and investors to ignore. Let’s do a brief tour of developments…

This week kicked off with the staggering news that AI chip maker, Nvidia, has now achieved a $1.84 trillion market valuation which is higher than both Amazon and Google. To understand the expectations baked into that valuation, reflect on Amazon’s projected 2024 revenues of circa $600 billion. Then know that Nvidia is expected by Wall Street analysts do just one tenth of that revenue number. The 90% revenue catch-up is somewhere in the future but the future numbers look big, very big. The famous AI evangelist and rescued CEO of OpenAI, Sam Altman, is actively seeking funding for the development of AI chips like those of Nvidia. The word ‘funding’ doesn’t really do this exercise justice. It’s almost nation building. Sam reckons he will need $7 trillion, or the combined GDP of Japan and France. Sounds dreamy, but he’s not alone.

Consulting firm, McKinsey, have published research suggesting the creator-focused application, Gen AI, deployed in 63 actual use cases could add $2.6 trillion to $4.4 trillion of economic benefits. Note these are actual business ‘use cases’. There’s more than dreaming going on here. In fact, Google has launched its Gemini workflow assistant to “supercharge your creativity and productivity”. Gemini is multi-modal which means it can create content using text, voice/audio, images and video. Its output can also be multi-modal. Think about a medical professional using an ‘assistant’ which can ingest a physician’s audio snippets/notes, X-ray images and MRI video scans. Also, we have moved past Chat GPT text prompts and free trials. Google is charging a $20 monthly subscription for its Bard successor, Gemini, to assist with email summaries, research, code-free data analytics and audio visual staff and customer education. Microsoft is also charging $20 a month for its Copilot AI Tool. Oh, and people and businesses really do pay for access to these AI tools.

While OpenAI started out in life as a not-for-profit entity, it is amazing to see that the OpenAI business is already generating annualised revenues of $2 billion. The use cases might even surprise. For example, McKinsey analysis shows that 73% of fashion executives named generative AI as a priority for their companies in 2024, but only 28% have actually deployed AI so far. It’s not just business prioritising AI adoption. The investment world, particularly in our world of early stage funding is acutely aware of venture capital (VC) funds pulling in their bullish horns and nursing some of their existing investments out of sick bay. However, AI-related VC investment is bucking that trend. Check out these data points from CB Insights:

- Broader venture funding fell 43% in 2023, but AI funding slipped by just 10%.

- The US actually witnessed AI investment grow by 10% in 2023. Europe dropped by 29% and Asia saddled with a China confidence crisis cratered by 61%.

- There were 22 AI unicorns (start-ups valued at $1 billion or more) created in 2023 which accounts for 31% of a global total of 71.

- Generative AI unicorns, in particular, are hitting warp speed wealth creation mode. Gen AI unicorns reached the $1 billion valuation mark in a little over 3 years, or half the time taken by unicorns in other sectors.

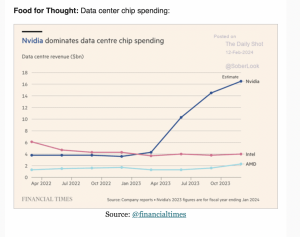

However, investment doesn’t just happen at a company level, big or small. If we consider Sam Altman’s funding estimate of $7 trillion, this investment capital will mainly be used to build facilities to manufacture those AI chips (fabs) and then house them (data centres). I have written previously about the linkage between the explosive growth of AI and the race by Big Tech to build the data centres supporting their digital cloud businesses. As a proxy for this linkage, the Financial Times has highlighted Nvidia’s dominance in the area of data centre spending:

Closer to home, the opportunity presented by data centres has attracted private equity giant, Blackstone, and prompted talks on a $900 billion acquisition of data centre construction leader, Winthrop Technologies. Clearly, the ramp up in investment activity on both a company and an infrastructure basis is signalling real AI revenues and real usage from businesses. And, it would be wrong to assume it’s part of the future. It’s now.

- Forbes reckon 83% of companies deem AI to be a top priority in their business strategy.

- MIT have said 9 in 10 organizations back AI to give them a competitive edge over rivals.

- More than 50% of Americans use voice assistants for information purposes (Source: Edison)

- Manufacturing businesses that utilize AI are performing 12% better than those using traditional methods only (Source: Microsoft)

Remember this is AI in its infancy. That 12% ‘edge’ is only going to grow. For me, there is now an additional competition-critical question for every business to add to existing queries on the progress of their digital and sustainability transitions. Have you boarded the AI bus yet….?