Amid the screaming and shouting I was hooked. It was two o’clock in the morning on a smoke-filled trading floor in Tokyo thirty years ago this month. The UK government was desperately trying to keep sterling in the European Exchange Rate Mechanism (ERM) and some currency trader friends thought a few of their rugby team mates might be interested in viewing the action. As the earliest global financial centre to open, Tokyo was going to get a front row seat at the battle between the Great British Pound(GBP) and the mighty German Deutsche Mark(DM).

It was no contest, but no less gripping. The frenzied GBP selling and rapid moves of short-term bank deposit rates through the night saw the largest bank traders in the world (mostly Japanese at the time) sensing their own personal George Soros moment. But, less subtle. The roaring of trader instructions down telephone “squawk boxes” pulled no punches on counterparty credit – “show me only Lloyds Bank” , “no sh*t Americans”, “no lubbish Engrand names”, “Jyamany banks only” – or the massive profit opportunity.

Banks typically have credit limits for specific currencies. That night the world’s biggest bank at the time, Dai-Ichi Kangyo Bank(DKB), was asked by his broker what was his required ticket size. The trader screamed “yaado”. In trader-speak a “yard” is a billion dollars but typical single deal limits would be in the tens or hundreds of millions. That night DKB wanted to be shown every DM on offer on the planet and there would be “no rimits”. Now, put that firepower in the context of Bank of England intervention the following morning amounting to £600 million. It was never going to be enough and the UK crashed out of the ERM less than 24 hours later on the 16th of September 1992, “Black Wednesday”. Soros grabbed the headlines but it was a relatively small group of financial traders who made the markets move in dramatic fashion and destroyed the credibility of the UK government. Fast forward to today, and there’s another Tory government facing increased scrutiny of its economic policies. Again, the real voters on these policies will not be in Tunbridge Wells but on the trading floors of New York, Tokyo, London and Singapore. And, the traders are twitchy.

To be fair, it’s not just sterling attracting scrutiny. This week saw the Bank of Japan (BOJ) intervene to stop the slide of the Yen for the first time since 1998. Clearly, a determined and aggressive approach from the US Federal Reserve to keep hiking interest rates is driving a painfully strong dollar in recent months. However, GBP weakness has been a long-running feature of currency markets. Since the Brexit vote in 2016 the volatility of GBP has been more elevated than other major currencies. Bank of America financial analysts went so far as to describe the trading characteristics of the GBP as being “similar to those of an emerging market currency”. Hence, the odd reference to the “Great British Peso” in articles published here and its recent fall to 37 year lows against the US dollar . This volatility of GBP can be likened to seismic tremors measured before volcanic activity. The sources of these credibility tremors are readily identifiable….

- Brexit: A first-in-history attempt by a sovereign nation to voluntarily reduce trade with its closest and biggest trading bloc partner in an era of supply chain stresses and logistics challenges plus a more insular approach from its next most important trading partner, the US, remains a strategy in search of a benefit.

- Government: Four prime ministers later, Brexit can be rightly identified as a major driver of political instability. However, that would be to ignore the growing reality of a shameless Tory desire to “cling-to-power” at all costs, including credibility, which even got a withering mention in the Archbishop of Canterbury’s sermon at the Queen’s funeral. A prime minister dependent on the support of David Cameron’s “mad swivel-eyed loons”, the secretive European Research Group(ERG), the culture “warriors-on-woke” and quite a few of John Major’s “bastards” is in danger of trying to keep too many of the wrong people happy.

- Trussonomics: The UK government’s economic policies look like a direct manifestation of incoherent Tory leadership election promises. The Institute for Fiscal Studies think-tank is already concerned about a run on the Great British Peso. Its worries are focused on the expectation that Truss’s loyal Chancellor, Kwasi Kwarteng, in his Budget this week will cut taxes and hope for “trickle down” growth in the economy while spending more, much more, on energy price freezes and military spending. The obvious result of less income(taxes) and more spend is hundreds of billions of pounds of additional debt on the sovereign balance sheet. The “growth hope” is unproven and the Treasury’s own independent forecaster, the Office for Budget Responsibility (OBR), has stated for the record that there is no evidence that tax cuts can “pay for themselves”.

These are major credibility issues already in play. And, this week’s interest rate decision from the Bank of England will hardly reassure. After a Fed hike of 0.75% earlier in the week there was a currency market expectation of the BOE matching that. But, no. The BOE decision was to hike by just 0.5% and, more worryingly, the BOE vote was badly split with 3 of 9 committee members going for 0.75% versus 5 going for 0.5%. So, even the BOE are not entirely sure what to do. Sadly, the Chancellor is sounding way too sure of himself. Consider the following:

- Kwarteng has blocked his own research unit, the OBR, from subjecting his budget to any modelling exercise as to the impact on growth, debt, balance of payments etc.

- The most senior official in the Treasury, Tom Scholar, has been sacked for his “orthodoxy” which is an unprecedented attempt to impose ideology on the UK civil service.

- Kwarteng (and Truss) seem convinced that tax cuts (for the rich) will “trickle down” to main street and drive economic growth despite the absence of any evidence or support from a heavyweight economist or think-tank. Indeed, the review of Donald Trump’s 2018 $2.3 trillion tax cut was very clear. The cuts didn’t pay for themselves, 60% of the benefits went to the top 20% of the income earners, and corporate tax revenues as a percentage of the US economy continue to fall.

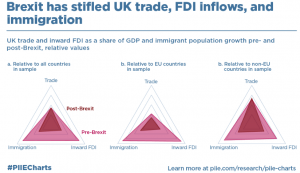

This “certainty” sounds familiar and almost defies common sense. Behaviourally, it seems reasonable to think that those who live month-to-month on their pay cheques will spend any incremental pesos or dollars received. On the other hand, a comfortably well-off individual is more likely to add the extra dollars to his or her bank account. That outcome seems even more likely in an economic downturn. Of course, in the areas of common sense and behavioural probability the UK government has form. All those Brexit promises and opportunities plastered on the sides of red buses have now been reduced to the glorious freedom to boost the suction power of your Great British vacuum cleaner. The wider world knows that sucks and, for good measure, has kept the receipts. In fact, the Peterson Institute has strikingly captured the trajectory of UK trade, foreign direct investment(FDI) and immigration in the graphic below:

The trade decline won’t come as a surprise but the shrinkage of foreign investment (FDI) is another tremor worth keeping an eye on. In other words, are international pools of capital less “certain” of growth or even payback and less willing to back the UK? No different to that Tokyo night 30 years ago, confidence is critical and can shift suddenly So, when the Financial Times(FT) reports this week that the UK has become more reliant on inflows of foreign money than at any time since records began in 1955, it is even more critical that confidence is maintained. Furthermore, the FT states that the UK trade deficit is the worst on record and that the current account deficit is the worst of the G7 nations. That means outside capital is being used to finance the UK’s record over-spend(vs income). Other people’s money, eh. How often have we written that script?

Like Brexit, I fear the UK government is locked into a flawed economic policy and hoping time will cloud memories. This is not the time for that approach. Foreign capital and traders could suddenly form the view that the UK budget is not “serious” and start thinking about the relative strength of other economies. Back in 1992, the UK inflation rate was triple that of Germany’s. What chance of that by Christmas this year? Possibly, more than Kwasi Kwarteng thinks. So, companies and investors might need to budget for another run on sterling if markets lose faith in the UK . It’s all fine and dandy for the faithful in Tunbridge Wells to say in Liz we Truss, but will the squawk boxes? Ah well, I’m still hooked.