As I briefly caught up on Love Island developments last night, I experienced an out-of-vacuum sensation. Thought. Could these cognitively challenged conversations between contestants be considered investment pitches by individual social media start ups? Don’t laugh. The speed at which talent-free idiocy can turn into million-follower Instagram franchises with ‘influencer’ royalties is a frighteningly real proposition. It would also be a mistake to dismiss this as just a reality TV phenomenon. The business or sector as an illustration is actually irrelevant from an investment perspective. Our focus today is speed.

Nobel Prize winner, Daniel Kahnemann, wrote Thinking, Fast and Slow a decade ago. This exploration of human decision-making highlighted the strengths and flaws in the two systems which drive how we think: System 1 is fast, intuitive, and emotional. System 2 is slower, more deliberative and logical. The field of behavioural finance has always assumed both systems interact whether one was a short term day trader or a long term value investor. Bitcoin or Buffet, we understood the difference. Now, I’m not so sure.

All I can see is ‘fast’ and it’s not just the speed of investment thinking. The digital economy is generating warp-speed growth for all types of businesses, from Dogecoin social media creator/influencer franchises to payment platforms like Stripe . Let’s consider some data I came across in recent days which really hammered home the point about speed. Firstly, I was flicking through the CB Insights update report on venture capital investing activity in Q2 and two figures stood out:

• Q2 2021 witnessed the birth of 136 new ‘unicorns’ – private companies which secure a valuation of more than $1 billion for the first time through a funding round or corporate activity. For context, that is six times the number achieved in Q2 2020 and higher than the 128 unicorns created in ALL of 2020.

• Tiger Global was the most active investor globally. The total of completed investments in the quarter by the Tiger team was more than 8 times the number completed in the same period a year ago. But here’s the jaw dropper; 81 deals were completed by Tiger in Q2 which works out at 1.3 deals per business day!

Yes, markets and valuations, are enjoying record highs which always helps System 1 thinking, per Kahnemann. So what could be driving the optimism? Of course, daily record highs and eye-catching valuations can create a virtuous circle of wealth creation, fund flows, FOMO and yes, greed. However, there’s another speed data point which is highly relevant and possibly the game-changer for venture capital firms. Start-up companies are no longer just fast growing, they are reaching globally significant size at hyper-fast speeds.

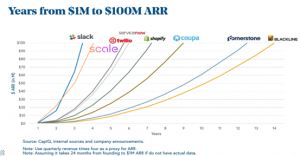

The excellent Not Boring blog www.notboring.co has generated so many followers it has just launched its own venture capital fund and shared a few interesting charts to explain their strategy. One graphic really caught the eye as it highlighted more recent vintages of start-ups are growing from $1 million to $100 million of annual recurring revenues(ARR) in ever-shorter time periods. Check out Slack below which has just been bought by Salesforce:

Clearly, higher revenue numbers earlier generates far higher valuations and incredibly attractive returns for venture capital investors. It is no surprise to see the CB Insights Q2 report highlighting global funding of start-ups has rocketed by 157% year-on-year to $156 billion. So let’s slow things down for a second and think about how speed is changing the venture capital fund world. My three key takeaways would be:

1. Companies can grow incredibly fast and achieve whopping valuations much earlier than in previous investment cycles. In many cases this is revenue(ARR) driven not just story and valuation euphoria.

2. Venture capital funds know there are more opportunities to find companies/investments which can generate 100-200x type returns.

3. One big win can erase lots of losers. Hence, portfolios are being built faster and with far more constituents – see Tiger and its staggering 1.3 investments per day.

My final thought is more challenging. As start up investors we may need to think fast, and faster. Spend less time trying to identify a small group of winners. Think about a bigger portfolio approach with a higher number of investments and the speed at which your investee companies can accelerate revenues to a significant level.

Bringing those thoughts closer to home it is striking to see Irish companies no longer exiting into the arms of a bigger global parent but choosing and executing hyper-growth strategies themselves. Ask yourselves would the past weeks’ headlines ten years ago have featured buy-out in the headline rather than foreign capital backing global growth ambitions below?

• Collison brothers’ Stripe takes a first step towards stock market – Irish Independent

• Xtremepush to double its workforce as it raises $33 million – RTE

• Covid testing pushes LetsGetChecked to $1 billion valuation – The Irish Times

All of these companies are focused on hyper-growth. And they also know another digital truth which we touched on before. The only barrier to entry is scale, global scale. Oh, and the winners in this competitive reality actually get off the island first.