I know it’s Lent but seriously???? The media wants us to worry about Stanley Johnson being given a knighthood by his disgraced son, Jeremy Corbyn flogging Bohemians’ football shirts and…. US right-wing presidential contenders frothing at the mouth about the threat to children from drag performances. And yet, there’s not a peep about the daily “Bakhmut” of 400 million US guns, or the jaw-dropping judicial revolt by Israel’s fighter pilots or the £80 billion loss to City prestige as ARM and CRH flee to New York. Perhaps the nonsense stuff is the flagellation our politics and media consumption deserves. However, behind the front page headlines far bigger sins are being hidden. Without even mentioning the usual “B” word, here’s another “B” which highlights the potential damage of missing the bigger picture; billionaire former New York mayor, Mike Bloomberg, has just warned that Bibi Netanyahu’s judicial coup in Israel is “courting disaster” and could make Brexit’s economic effects look like “bubkes”, or small beans. Wowzers! What else are we missing? We have a few thoughts and bigger pictures to consider this week….

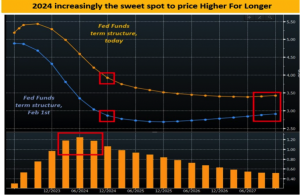

Regular readers will know that the Gravitas mission is to identify CHANGE. They will also know that we believe the cost of money is the fundamental driver of business and asset values. That cost is commonly referred to as “interest rates”. And we see change, plus something new. Thanks to some interesting charts on the excellent Macrocompass.com blog, we can firstly see that bond market traders have adjusted their views since the beginning of February. The key change is that they now believe US interest rates in December 2024 will now be over 4%. Just one month earlier, investors thought the US monetary authorities(the Fed) would be cutting rates to 2.75% by end 2024. Here’s the change of view in graphic format:

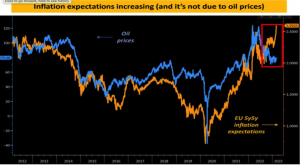

This ‘higher-for- longer’ rates view is not just a US phenomenon. Europe’s bond markets are signalling the same, but with a twist. The perceived wisdom in markets is that stubbornly high inflation in recent data will force central banks to keep rates higher for longer. However, the source of that inflation might change. In Europe, the criminal invasion of Ukraine and rocketing energy prices have been consistently identified as the driver of inflation, until now. The following chart of long-term (5 year) inflation expectations has “decoupled” from oil prices ie energy costs are no longer driving inflation expectations in Europe:

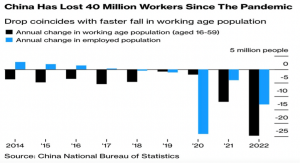

So, if it isn’t energy prices what is the new inflation fear? Well, it could be the cost of labour, wages. That’s why the US jobs report (Non-Farm Payrolls) on Friday will be watched so closely. Despite deteriorating business activity data, the US labour market remains incredibly strong. The disconnect is unusual and the subject of much debate focused on Covid, Gen Z trends, early retirements, demographics etc. All these factors are potential drivers but then I spotted an amazing statistic; China has lost a whopping 40 million workers since 2020. For context, that’s the equivalent of the entire German workforce disappearing in a couple of years. That’s demographics in action, and Europe is not quite China, but perhaps the long-term inflation chart above is hinting at a future demographic tightness in European labour markets. Here’s the stunning chart from China’s own National Bureau of Statistics showing the worker evaporation:

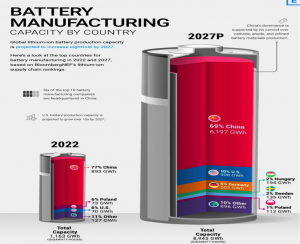

It’s not just worker demographics undergoing structural change. How about work itself? And we’re not talking about work-from-home versus the office. Only last week we wrote “A Time To Rebuild?” and this writer increasingly believes the global economy is embarking on a massive infrastructure project. You may have previously read that China consumes more cement every two years than America consumed through the whole of the 20th Century(!). However, the next big build phase is not really cement-driven. It’s a global $275 trillion spend shift away from fossil fuels by 2050. And the charts are already exploding. Take the following one from Bloomberg showing the 8-fold increase projected for lithium-ion battery manufacturing capacity over the next 5 years:

Let’s just say there are big global changes happening but we should be wary of simplistic(often negative) interpretations of what higher longer term interest rates means for business. The growing demand(and confidence) for money to fund capital intensive projects in cleantech is fundamentally a good thing for the global economy. Higher interest rates tell us that there will be competition for that capital. However, that’s not necessarily a bad thing either as it promotes capital discipline. So, keep an eye on the big pictures not the front page headlines.