The old adage that financial markets climb a wall of worry is very well known. However, human beings are particularly poor at identifying in advance exactly which specific worry or risk might spook the markets. Furthermore, the army of 2020 hindsight ‘gurus’ providing post-factum analysis has never been shy of rationalising a market swoon despite this same analysis providing zero commercial value. Risk is a fact of life in capital markets and market fluctuations come and go.

Indeed, my former colleagues still tease me about a previous analytical role of mine in the early Noughties by mimicking my high pitched squealing about the potential impact of Bird Flu. Not surprisingly I have been on the receiving end of a few playful calls already about the Coronavirus outbreak in Wuhan. Unperturbed by this ribbing, I am going to go out on a limb here and state that markets are at an interesting inflection point where heightened levels of market exuberance are coinciding with the limited risk muscle memory of previous mystery virus outbreaks in China. Here’s a quick reminder of the impact of the SARS outbreak in 2002-2003 and a number of current exuberant data points plus charts.

First, let’s remind ourselves of the SARS effect on markets in 2003. From November 2002 when the first SARS case was identified in Southern China to March 2003 the S&P 500 index of the largest US stocks fell by 16%. I recall a senior trader at a large Swiss Bank telling me about very anxious risk management meetings and the less-well-known critical significance of the potential global halt of cross border movement of people and goods. Let’s just say the economic worst-case scenarios were not pretty. Ok, that’s the scary reminder bit. What about the exuberance we referenced earlier? Take your pick from the following data points and charts.

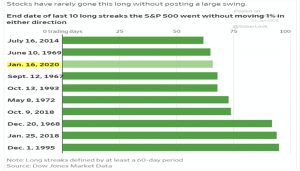

Markets are rising on a daily basis but in terms of volatility, things have been “quiet”, i.e. the number of individual big day moves has been non-existent for a long period now. Stocks rarely go this long without a big move. The chart below illustrates where the current period ranks in the league tables of complacency.

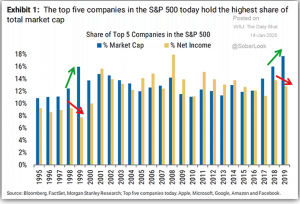

Individual stocks showing parabolic moves can also be a “tell” of exuberance so we are quite intrigued by Tesla’s recent moves. Its market capitalisation (value) now exceeds that of the entire US auto sector (GM, Ford etc). This prospect was written up in this column previously as a potential 2020 uber-surprise; little did we think it would happen within the first three weeks of the year. It’s possible there is a single stock story there but a quick look at the 5 largest stocks in the US also raises a few eyebrows. The concentration of capital in the US market’s 5 largest companies is at a twenty-year high per this Bloomberg chart below.

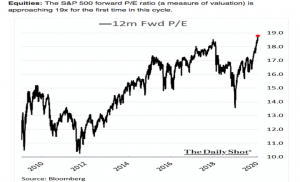

It’s not just the mega-cap end of the market. The overall market is cruising to record valuation levels as a multiple of future earnings (P/E) for this business cycle. The chart below shows a pronounced spike in recent months courtesy of the excellent Daily Shot blog/newsletter.

It is fair to say that if the newsflow on the Coronavirus outbreak continues to escalate the chances of investors sitting on 30-40% gains over the past 12 months taking some money off the table is pretty high. On a more positive note, corrections are healthy and the overall picture of the global economy and financial conditions is pretty robust. There is still a wall of central bank monetary support, historically low costs of capital and signs of a pick up in the global manufacturing sector. Temporary shocks also present cheaper opportunities to revisit great stories missed in the big moves over the past year. So, it might be time to be greedy when others fearful as Warren would say.

In the meantime, I will brace myself for ridicule and a round of Coronas on me in a few weeks at a local hostelry with former colleagues. As the great traders know, it’s best to stay humble and liquid….

Enjoyed this blog? Then why not check out our other great content by clicking here!