ESG might strike some as a larger company fad to keep investors comfortable that the C-suite are good corporate citizens on environmental, social and governance issues. Wrong. We often say actions speak louder than words, particularly investment. Check out Spark Crowdfunding’s platform whose last three campaigns raised an eye-catching €1 million for companies providing solutions to real environmental challenges. Accucolour is the latest start-up company to successfully raise funds for innovative products allowing fast-track recycling of plastic bottles. Pardon the pun but an ESG ‘ecosystem’ is emerging.

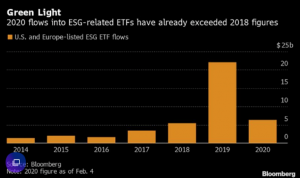

ESG is here to stay and companies who can help larger companies meet ESG benchmarks/standards are going to do rather well. The flow of funds into investment products that track ESG friendly corporates is striking and provides further incentive for laggard companies to up their game or face valuation discounts in public markets or M&A discussions. Already, fund flows 6 weeks into 2020 have surpassed total flows for all of 2018 as this graphic from Bloomberg illustrates:

To get a flavour of the punishment inflicted on less ESG friendly companies, consider the case of Exxon Mobile whose valuation has crumbled by $184 billion since its peak in 2014. Clearly, an excess supply of oil, consequent lower prices and the growth of renewable energy have hurt cash flows. However, that doesn’t explain all of Exxon’s collapse from being the world’s most valuable company as recently as 2012. Climate change is the elephant in the room which is applying an ESG discount to those still-enormous cash flows.

The opportunity for smaller companies is to help these monster enterprises join the ESG-friendly club. There is no shortage of cash to throw at this challenge and no shortage of opportunities for innovative solutions. Just yesterday BP, under a new Irish CEO, announced plans to “reinvent” the oil giant by setting a net-zero carbon footprint target by 2050. Whether BP meets those targets or not is up for debate but it is absolutely certain they are going to spend BIG to reposition the firm.

That’s a double whammy of good news for entrepreneurial spirits. It’s always good to know there are some very rich and desperate ESG customers out there, as well as an informed and active investor base consistently funding great startups at Spark Crowdfunding. These investors are not alone. Currently, $30 trillion of investment funds use ESG criteria in their securities selection process. So, as the political world grapples with daily Watergate flashbacks and worse, it would seem prudent once again to take the sage advice of that era to follow the money…..

Interested in learning more about ESG? Then check our previous blog on the topic “ESG: Corporate Health Is Your Wealth“!