The prevailing political narrative of recent years has been the rise of populism and right wing parties but the elections in Spain at the weekend give pause for thought.

Socialists greatly increased their number of seats and conservative parties suffered crushing losses. As Jeremy Corbyn waits in the wings in a Brexit-paralysed UK and a succession of Democratic US presidential contenders advocate centre-left solutions, there are grounds for a reappraisal of the policy solutions likely to be demanded by electorates.

The high priests of capitalism are also taking note. Ray Dalio, the founder of the largest hedge fund in the world, has recently made the noteworthy observation that “capitalism is a fundamentally sound system that is now not working well for the majority of people”.

The World Economic Forum has also warned that rising income inequality poses the biggest threat to the global economy over the next few years. Most surprisingly, surveys of the uber-wealthy by private banks like UBS are highlighting income inequality as their clients’ biggest fear – not inflation, not China, not terrorism, not rising interest rates, not recession, not trade wars. Remarkable.

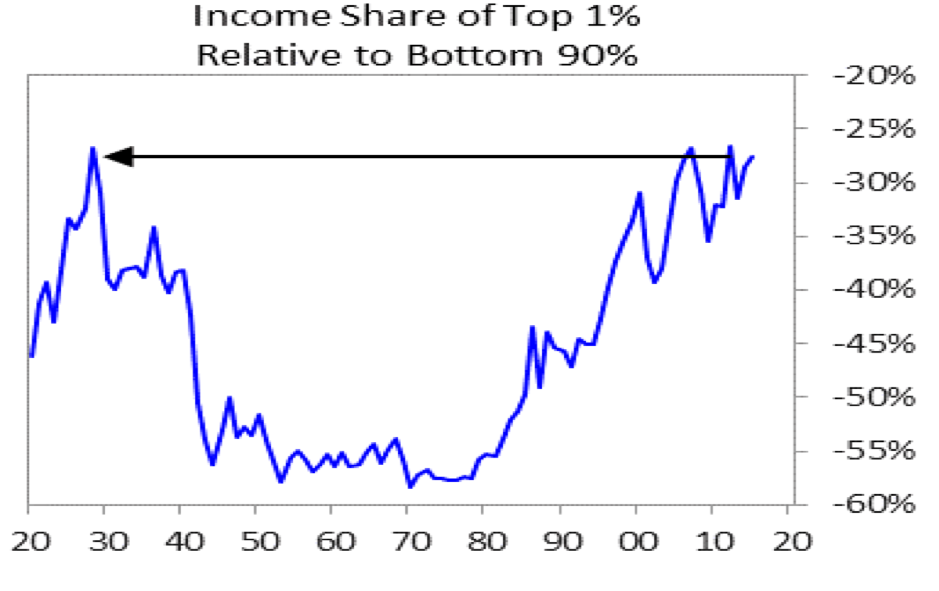

Dalio, a keen student of history, notes that the conflict between populists of the left and right contains echoes of the 1930s and he provides a striking Income Inequality chart for historical context. The chart below shows the wealth gap is indeed the highest since the late 1930s:

One senses something has to give. The perennial policy dilemma is described rather well by Dalio when he states that “most capitalists don’t know how to divide the economic pie well and most socialists don’t know how to grow it well”.

Some readers will have seen US Presidential contender Elizabeth Warren propose a wealth tax for fortunes in excess of $50m but wealth taxes scare the hell out of lots of governments for the following reasons:

- In response to wealth taxes, the wealthy remove funds from the relevant tax jurisdiction

- Wealthy investors reduce investment as incentives to make incremental profits/returns are reduced

One wonders is there a middle ground where passive deposits of cash over a particularly high level of, say $20m, incur an additional annual tax charge (see property taxes) UNLESS the equivalent amount is invested in smaller companies/start-ups operating in the same tax jurisdiction.

There are already numerous EIIS-type schemes in Ireland, UK and US which provides investors with the option of investing in start-ups which have attractive tax incentives for the investor eg. 40% tax back in Ireland for EIIS investments.

The difference for the super wealthy is that these schemes would become mandatory to offset a wealth tax. The policy message would be clear: Use it or Lose it.

Taxes or any mandatory directive on personal capital is never popular but these are challenging times in many societies and the 1% are already acknowledging a problem and the risk of a chaotic backlash.

The attractions of EIIS-type schemes for policy makers would be a much greater chance of capital remaining onshore and a tangible support for business formation/employment from the private sector.

In the event of such policies emerging equity crowdfunding platforms, such as Spark Crowdfunding, will be a natural conduit for investment flows. For both investors and start-up companies today there could be real opportunities in early utilisation of crowdfunding platforms.

Firstly, companies can gain the experience of running a fundraising campaign in preparation for potentially much larger pools of capital being available in the future.

Second, investors will undoubtedly see the attractions of early investment in a limited number of franchises which in the near future could be chased by a wall of new monies seeking refuge from capitalism’s response to an unsustainable situation.

Now think about that…large pools of capital chasing limited opportunities. Early crowdfunding movers might be able to help, but at a pretty price!