A year ago I wrote “Three Market Charts To Look Up!” but this year I could ask a chat bot to write the piece. Almost. We’re not quite there yet but generative text powered by artificial intelligence (AI) is certainly capable of delivering quality pictures and prose. However, thankfully the AI chatbots like ChatGPT or DALL-E still need a prompt and, critically, some context. So, I thought I’d prompt some thoughts with pictures which might develop this year and also remind us of those three pictures from last year. Last year we highlighted i) increasing crypto adoption ii) the potential underperformance of growth stocks and iii) a Chinese economy hobbled by property woes. Well, two out of those three themes developed as expected while crypto grabbed lots of headlines but for mostly the wrong reasons. So here goes with four more picures which I believe will develop significantly in 2023:

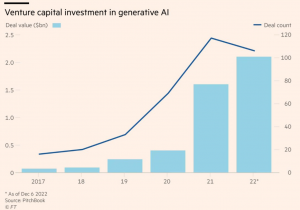

Artificial Intelligence (AI): No surprise given our introductory paragraph. The excellent database resource, Our World in Data, shows annual corporate investment in AI doubling from circa $80 billion in 2019 to over $160 billion by mid 2021. More specifically, the explosion of interest in generative AI (ChatGPT, DALL-E etc) has seen VC investment increase by 425% to $2.1 billion since 2020. The VC data provided by Pitchbook is in the Financial Times chart below:

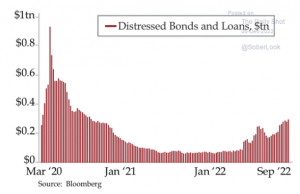

Corporate Credit: The standout macro factor which drove markets last year was not actually Ukraine, Covid or inflation. Thanks to AI and powerful computing at macro research analytics firm, Quant Insight, we know that it was actually the cost of money which was the most powerful factor. Yep, rising interest rates affect our ability to borrow. For companies this can cause real problems if loans or bonds need refinancing. Interestingly, 2022 saw the fewest number of bankruptcies in 10 years. However, this week home goods retailer Bed Bath & Beyond told shareholders bankruptcy is now a possibility. And strikingly, the same Quant Insight analytics platform is seeing the macro emphasis move away from rates(interest) to credit(debt risk). In real world terms, the knock–on effect of tighter funding conditions will begin to reveal themselves in 2023 as companies with challenged balance sheets/indebtedness – aka ‘zombies’ – move into distressed territory. See the Bloomberg chart from the Daily Shot newsletter below:

Housing: Of course, rising interest rates don’t just impact companies. The biggest item on an individual’s balance sheet is likely to be a house and as interest rates rise, so do mortgage rates. The push/pull effect of higher interest/mortgage rates can reduce the price of the assets being purchased, in this case houses rather than growth companies. The chart below from credit ratings agency, Fitch, indicates a more difficult 2023 for a number of major housing markets.

Battery Production: In some ways, the best proxy for the planet’s race towards reducing fossil fuel dependence is the enormous investment currently being ploughed into production facilities for batteries to power a generational shift to electric vehicles(EV). China in 2020 accounted for 75% of global battery production capacity but that’s going to change. Europe intends to up capacity 5-fold by 2030 and the US isn’t just home-shoring semiconductor manufacturing. A whopping $40 billion of funding has been committed to US based battery production since 2021 and overall investment in the EV ecosystem(auto plants, charging networks, batteries etc) probably exceeded $100 billion in the past 12 months alone. Consultants McKinsey have published a lot of this data and the graphic below captures the serious acceleration in capacity expansion between now and 2025.

As we have written before, there will be winners and losers in every calendar year but don’t lose sight of the bigger pictures. These multi-year developments don’t fit into neat annual forecasts but could fit into the longer-term investment portfolios of the curious.